So, you’ve got your eye on a Tesla Model 3, or maybe you’re already cruising down the Pacific Coast Highway in one. It’s an amazing piece of technology. But as you probably know, the costs don’t stop after you drive off the lot. Finding affordable Tesla Model 3 insurance in California is a crucial next step, and it can be a surprisingly complex journey.

You’re not alone in asking about the insurance costs for this popular EV. We’ve done the deep dive to bring you a clear, no-fluff guide on what to expect, why the prices are what they are, and how you can find the best coverage without breaking the bank.

How Much Is Insurance for a 2025 Tesla Model 3 in California?

The average Tesla Model 3 insurance cost in California ranges from $3,650 to $4,250 annually for full coverage, which translates to approximately $305 to $354 per month. For context, this is substantially higher than California’s average car insurance rate of $2,479 per year.

Breaking down the numbers:

- Full Coverage: $3,650-$4,250 annually ($305-$354 monthly)

- Liability Only: Around $1,300 annually ($108 monthly)

- Bay Area Residents: Expect the higher end of these ranges due to increased traffic density and theft rates

Several factors influence your Tesla Model 3 insurance cost per month:

Driver-Related Factors:

- Age and driving experience

- Driving record and claims history

- Credit score (where legally allowed)

- Annual mileage

Location-Specific Factors:

- Tesla Model 3 insurance cost Bay Area tends to be 15-25% higher than rural areas

- Crime rates and traffic density in your ZIP code

- Local repair shop availability

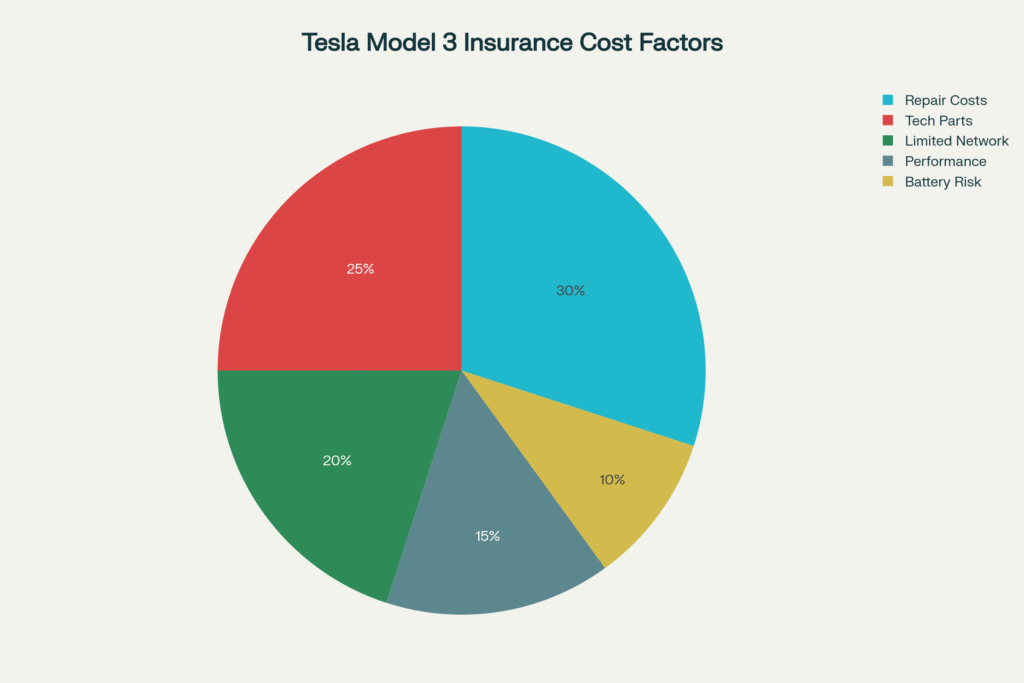

Why Is Tesla Insurance So High in California?

Understanding why Tesla 3 insurance cost in California is elevated helps you make informed decisions. The high premiums aren’t arbitrary—they reflect real cost factors that insurance companies must consider.

1. Expensive Repair Costs

Tesla vehicles use specialized aluminum construction and proprietary parts that can only be sourced through Tesla or certified suppliers. A minor fender-bender that might cost $2,000 to repair on a traditional vehicle could easily run $5,000-$8,000 on a Model 3.

2. Advanced Technology Components

Your Model 3’s sophisticated features—from the 15-inch touchscreen to Autopilot cameras and sensors—are expensive to replace. If these components are damaged in an accident, repair costs can skyrocket.

3. Limited Repair Network

Unlike traditional vehicles that can be repaired at thousands of shops, Tesla repairs often require certified technicians and specialized equipment. This limitation increases costs and repair times.

4. Performance Classification

Insurance companies often classify Tesla vehicles similarly to performance cars due to their instant torque and acceleration capabilities, leading to higher risk ratings.

5. Battery Replacement Risk

Tesla batteries can account for up to 50% of the vehicle’s value. While battery failures are rare, when they occur, the replacement cost significantly impacts insurance calculations.

Does Tesla Offer Car Insurance in CA?

Yes, Tesla offers car insurance in California, and it’s become an increasingly popular option for Model 3 owners. Tesla Insurance launched in California in 2019 and has since expanded to 12 states.

Key Features of Tesla Insurance in California:

- No Safety Score Pricing: Unlike other states, California privacy laws prevent Tesla from using real-time driving data to adjust premiums

- Streamlined Claims: Direct integration with Tesla service centers can expedite repairs

- Competitive Rates: Often 10-30% lower than traditional insurers for Tesla owners

- Recent Changes: Tesla switched to in-house underwriting in 2025, offering a 3% discount to existing customers who switch

Important Note: Tesla Insurance recently implemented a 12% rate increase for California customers in 2025, though they still often remain competitive.

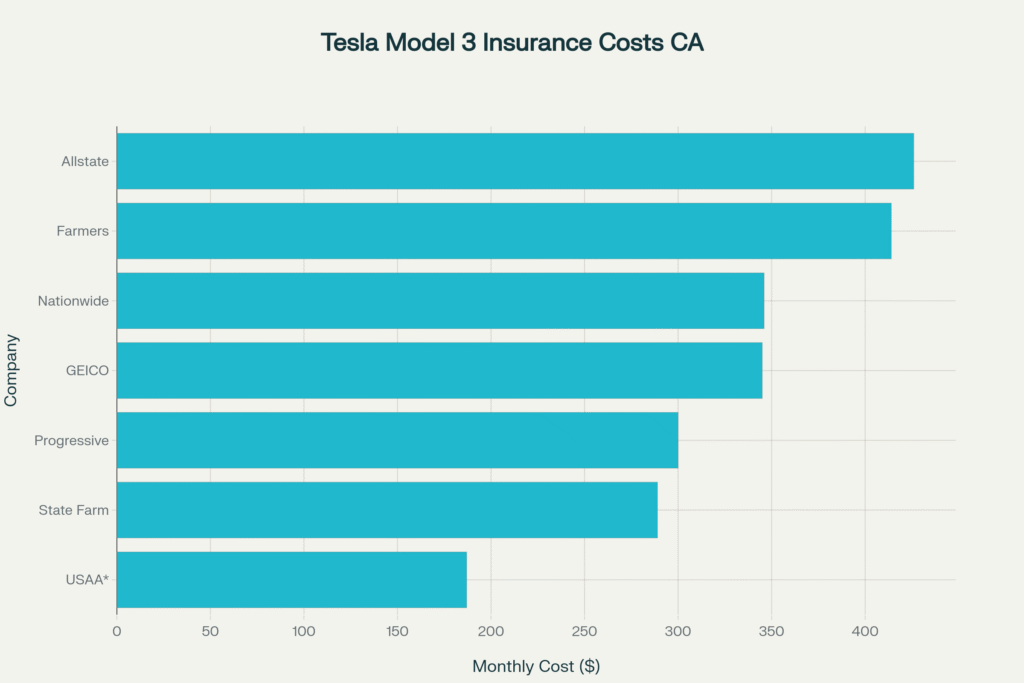

Best Insurance for Tesla Model 3 in California

USAA – Best Overall Value

- Average cost: $187/month (military members only)

- Exceptional customer service and claims handling

- Military-specific benefits and discounts

State Farm – Best for Safe Drivers

- Average cost: $289/month

- Strong customer satisfaction ratings

- Good driver discounts and bundling options

Progressive – Best Technology Integration

- Average cost: $300/month

- Snapshot program for usage-based discounts

- Strong digital tools and customer app

GEICO – Budget-Friendly Option

Farmers – Best for California Residents

- Average cost: $414/month

- Electric vehicle discount available in California (one of the few)

- Strong local agent network

Electric Car Insurance Discounts in California

California offers several opportunities for electric car insurance discounts, though availability varies by insurer.

Available EV Discounts:

- Farmers Insurance: Offers specific EV discounts in California (percentage not disclosed)

- Travelers: Provides hybrid/EV discounts (amount varies)

- Mercury Insurance: EV discounts that can be combined with other vehicle-based discounts

- Tesla Insurance: Sometimes offers promotional discounts for switching

Important Limitation: AAA offers a 5% hybrid/alternative fuel discount but specifically excludes California from this program.

Additional Ways to Save:

- Low Mileage Discounts: Many EV owners drive less due to range considerations

- Multi-Policy Bundling: Combine auto and home insurance

- Safety Features: Tesla’s advanced safety systems may qualify for additional discounts

- Pay-in-Full: Annual payment discounts of 5-10%

Tesla Model 3 Insurance Cost Geico vs Other Providers

When comparing Tesla Model 3 insurance cost Geico to other major insurers, here’s what our research found:

| Insurance Company | Monthly Premium | Annual Premium |

|---|---|---|

| USAA (Military Only) | $187 | $2,244 |

| State Farm | $289 | $3,468 |

| Progressive | $300 | $3,597 |

| GEICO | $345 | $4,145 |

| Nationwide | $346 | $4,154 |

| Farmers | $414 | $4,971 |

| Allstate | $426 | $5,113 |

GEICO Tesla Model 3 Analysis:

While GEICO isn’t the cheapest option for Tesla Model 3 insurance, they offer several advantages:

- Reliable claims service

- Easy online management

- Good customer satisfaction scores

- Available statewide in California

Frequently Asked Questions

How much is a Tesla 3 to insure?

A Tesla Model 3 costs approximately $3,650-$4,250 annually to insure in California for full coverage, or $305-$354 per month. This represents a 40-60% premium over the state’s average car insurance costs.

Does Tesla offer car insurance in CA?

Yes, Tesla offers its own insurance program in California. It’s available to all Tesla owners and often provides competitive rates, though it recently implemented a 12% rate increase in 2025.

Why is Tesla insurance so high in California?

Tesla insurance is expensive due to high repair costs, expensive technology components, limited certified repair shops, performance vehicle classification, and potential battery replacement costs.

How much is full coverage on a Tesla?

Full coverage for a Tesla Model 3 in California averages $3,650-$4,250 annually. This includes liability, collision, and comprehensive coverage required by most lenders.

How much is insurance for a 2025 Tesla Model 3?

2025 Tesla Model 3 insurance cost California averages $305-$354 per month for full coverage. Rates vary significantly based on your driving record, location, and chosen coverage levels.

Is Tesla a lot to insure?

Yes, Teslas are among the more expensive vehicles to insure, typically costing 40-60% more than the average vehicle due to high repair costs and advanced technology.

What is the best car insurance in California?

For general California drivers, Progressive offers the lowest average rates at $1,641 annually. However, for Tesla owners specifically, USAA (military only) and State Farm often provide the best combination of service and value.

How much value does a Tesla lose after 3 years?

A Tesla Model 3 typically loses 25-35% of its value within the first three years, which is actually better than many vehicles in its class. After three years, expect to retain 65-75% of the original purchase price.

How much is car insurance in California per month?

The average car insurance in California costs $207 per month ($2,479 annually) for full coverage, making Tesla insurance premiums 45-70% higher than the state average.

Which car is the cheapest to insure in California?

Generally, vehicles like the Honda CR-V, Toyota Camry, and Subaru Outback are among the cheapest to insure in California due to lower repair costs and theft rates.

Why is car insurance so expensive in California?

California’s high insurance costs stem from dense traffic leading to more accidents, high litigation rates, expensive repair costs, significant vehicle theft, and the state’s high cost of living.

What is the cheapest insurance for full coverage in California?

According to recent studies, Wawanesa General offers the cheapest full coverage insurance in California at $1,214 annually, followed by GEICO at $1,291 annually

Checkout: Best car insurance for EVs: Hidden Costs