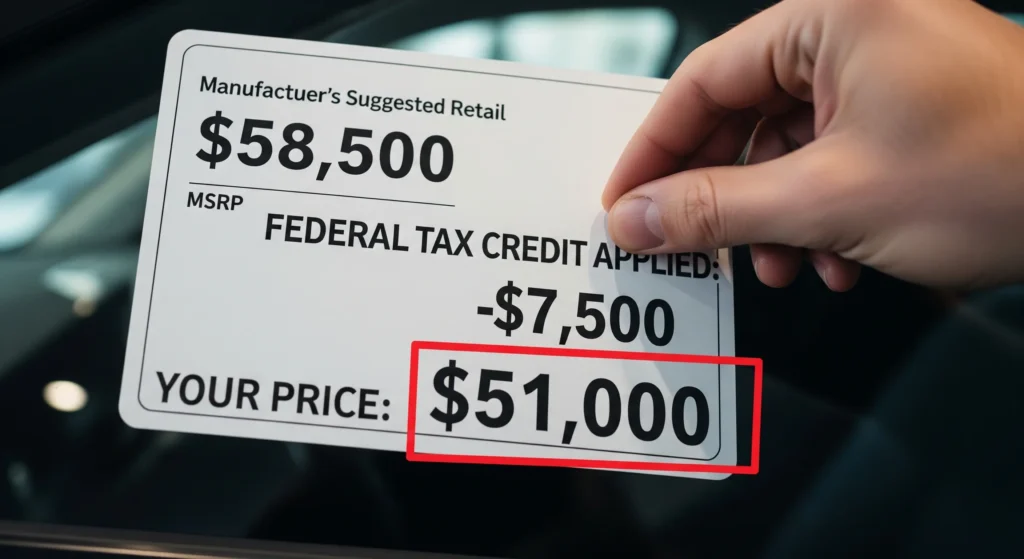

You heard the news: the massive $7,500 federal EV tax credit, the one that helped convince so many Americans to go electric, officially expired on September 30, 2025. Does that mean your dream of an affordable electric car is gone with it?

Take a deep breath. The answer is a resounding “no.”

The landscape has certainly changed, and it happened fast. The 2022 Inflation Reduction Act (IRA) had originally set up these popular incentives to run all the way through 2032, giving everyone a long runway to make the switch. But in a sudden legislative reversal, Congress passed the “One Big Beautiful Bill Act” (OBBBA) in July 2025, abruptly cutting the program short. The result was a frantic, last-minute rush as thousands of buyers scrambled to lock in their savings before the deadline, creating a massive surge in EV sales.

If all this sounds confusing and a little frustrating, you’re not alone. But here’s the good news: the end of that one big federal program marks the beginning of a new, smarter era of EV savings. The game has shifted from trying to win a single, nationwide lottery ticket to embarking on a more strategic, local treasure hunt. And for the savvy buyer who knows where to look, the treasure is very real.

This shift carries an important lesson. The sudden termination of a decade-long federal program reveals just how quickly government incentive policies can change. What was promised for 2032 was gone by 2025, a stark reminder that even long-term programs aren’t set in stone. This new reality places a premium on decisiveness. When a great state or local incentive becomes available, especially one with a time limit or a limited budget, the lesson from the federal credit’s demise is clear: act on it. Waiting and assuming it will be there forever is a risky strategy.

This guide is your new map for that treasure hunt. First, we’ll help those of you who bought a car right before the deadline to make sure you can claim the credit you’re owed. Then, we’ll dive deep into the new world of state-level incentives, spotlighting the states where the biggest money is and showing you how to “stack” different programs to save thousands. Finally, we’ll give you a concrete, step-by-step playbook to navigate your EV purchase in this new world. The rules have changed, but the savings are still out there. Let’s go find them.

A Final Look in the Rearview Mirror: Did You Squeeze In Before the Deadline?

This first section is a dedicated service for a very specific group of people: those of you who ordered an electric vehicle right around the September 30, 2025, deadline. If you’re worried about whether your car, which might not even be in your driveway yet, will still qualify for the old federal credit, this part is for you.

The “Binding Contract” Lifeline

Recognizing that thousands of people would be caught in this exact situation, the IRS created a critical exception. In simple terms, if you signed on the dotted line and put money down for an EV on or before September 30, 2025, you are likely still eligible to claim the credit, even if you take possession of the vehicle long after that date. This is known as the “binding written contract” rule, and it’s a lifeline for last-minute buyers.

To make sure you qualify under this provision, you need to have your paperwork in order. Here is a simple checklist to confirm you’re in the clear.

Your “Last Chance” Checklist

- Check Your Paperwork: The most important document is your purchase agreement. It must be in writing, and it must be dated on or before September 30, 2025. Critically, it needs to be signed by both you and the seller (the dealership) and should clearly outline the terms of the sale. A simple pre-order form might not be enough; it needs to be a contract that would be legally enforceable.

- Find Your “Time of Sale” Report: At the time you signed your contract, the dealer was required by the IRS to provide you with a “Time of Sale” report. This document is your golden ticket. It contains crucial information, including the vehicle identification number (VIN) and the official sale date, which serves as the primary evidence to the IRS that your purchase was initiated before the program expired. Keep this document in a safe place with your other tax records.

- Get Ready for Tax Time: You don’t claim this credit immediately. You will claim it when you file your federal income taxes for the 2025 tax year, which you’ll likely do in early 2026. The specific form you’ll need is IRS Form 8936, Clean Vehicle Credit.

A Simple Guide to the Old Rules

Qualifying under the binding contract rule means you still have to meet the complex eligibility criteria that were in effect before the program ended. These rules were notoriously tricky and created a challenging environment for both consumers and carmakers. Here’s a brief refresher on the main hurdles you had to clear.

- Price Caps (MSRP): The government set a firm ceiling on how much a qualifying vehicle could cost. For new vehicles, the Manufacturer’s Suggested Retail Price (MSRP) could not exceed $80,000 for trucks, SUVs, and vans. For all other vehicles, like sedans, the cap was $55,000. For those who bought a used EV, the sale price had to be $25,000 or less.

- Income Limits (MAGI): Your income also played a major role. The limits were based on your Modified Adjusted Gross Income (MAGI). For a new vehicle, the caps were $300,000 for married couples filing jointly, $225,000 for heads of household, and $150,000 for single filers. For a used vehicle, the limits were lower: $150,000 for married couples, $112,500 for heads of household, and $75,000 for single filers. Crucially, the law included a very consumer-friendly provision: you could use your MAGI from either the year you purchased the car (2025) or the prior year (2024), whichever was lower, to qualify. This was a huge help for people whose income might have fluctuated.

- The “Made in North America” Rule: This was one of the most significant restrictions. To qualify for the new vehicle credit, a car must have had its final assembly in North America. This rule immediately disqualified many popular models from European and Asian manufacturers.

- Complex Battery Rules: The most confusing requirement of all was related to the vehicle’s battery. The full $7,500 credit was split into two $3,750 halves. To get the first half, a certain percentage of the battery’s components had to be manufactured or assembled in North America. To get the second half, a certain percentage of the battery’s critical minerals (like lithium and cobalt) had to be extracted or processed in the U.S. or a country with a free-trade agreement. These percentage requirements were designed to increase each year, making it a constantly moving target for automakers and a major source of confusion for buyers.

To help you verify your eligibility at a glance, the table below consolidates all the key requirements under the now-expired federal program.

The “Binding Contract” Eligibility Reference

| Requirement | New Vehicles (Up to $7,500) | Used Vehicles (Up to $4,000) |

| Purchase Deadline | Binding contract signed by Sept. 30, 2025 | Purchased by Sept. 30, 2025 |

| MSRP Cap (Vans/SUVs/Trucks) | $80,000 | N/A |

| MSRP/Price Cap (Other Cars) | $55,000 | $25,000 |

| Income Cap (Married Filing Jointly) | $300,000 | $150,000 |

| Income Cap (Head of Household) | $225,000 | $112,500 |

| Income Cap (Single) | $150,000 | $75,000 |

| Vehicle Assembly Location | North America | N/A |

| Key Battery/Mineral Rules | Met specific sourcing percentage thresholds | N/A |

The New Frontier of Savings: Why Your Zip Code is Your Secret Weapon

Now that we’ve addressed those who bought under the old system, let’s turn our attention to the future. With the federal credit gone, the center of gravity for EV incentives has fundamentally shifted. It has moved from Washington D.C. directly to your state capital, your city hall, and even your local utility provider’s office. Your ability to save thousands of dollars on an EV purchase now depends more on your zip code than on any single national policy.

This marks a profound change in the U.S. electric vehicle market. Previously, automakers could rely on a single, nationwide incentive to anchor their marketing and pricing strategies. Now, they face a patchwork of wildly different state programs. This creates a “balkanization” of the market, where some states become EV “hot spots” while others become “deserts.”

Consider the logic from a car manufacturer’s perspective. If a state like Colorado is offering up to $15,000 in stacked incentives, a $40,000 EV effectively becomes a $25,000 car for some buyers. In a neighboring state with no incentives, that same car is still $40,000. Where would you, as the automaker, send most of your inventory? Where would you focus your advertising budget and dealer training? You’d go where the cars are easiest to sell.

This dynamic creates a feedback loop: states with generous incentives see more EV models available, more knowledgeable dealers, and higher sales, which in turn encourages more investment in things like public charging. Meanwhile, states without incentives risk falling further behind. For you, the consumer, this means the selection of EVs at your local dealership could be dramatically different from what a friend sees just one state over.

Introducing “Incentive Stacking”

In this new landscape, the key strategy for maximizing your savings is a concept called “incentive stacking.” Think of it like making the perfect sandwich. The old way was like getting one giant, pre-made sub from the federal government—it was big, but it was one-size-fits-all. The new way is to go to a gourmet deli and stack your own creation.

You might start with a thick slice of a tax credit from your state, add a layer of a point-of-sale rebate from a local air district, and top it off with a sprinkle of savings on a home charger from your utility company. It takes a bit more effort to find all the ingredients, but the final result can be just as satisfying, and it’s often more tailored to your specific situation.

While it’s true that no single state program may offer the full $7,500 on its own, the power of stacking is that the combination of programs often can. As we’ll see in the examples to follow, it’s possible in some states to stack programs to achieve savings of $15,000 or even more. This is the new frontier of EV savings.

State Spotlights: A Cross-Country Tour of the Best EV Deals

This is the heart of our guide. To show you what’s possible in this new, state-focused world, we’re going on a cross-country tour of some of the best and most interesting EV incentive programs available in late 2025 and 2026. Each state has a different approach, revealing its unique policy goals—whether that’s targeting air pollution, promoting social equity, or simply encouraging rapid adoption.

Colorado: The Champion of Stacking

Colorado has created one of the most powerful and multi-layered incentive systems in the country, making it a prime example of how to master the art of incentive stacking. The state’s programs are cleverly designed not just to sell more EVs, but to solve two problems at once: making electric cars affordable for working families and getting the oldest, most polluting gas-powered cars off the road.

Let’s imagine a family in Aurora. They have a 13-year-old gas guzzler they’re ready to trade in, and their household income qualifies them for the state’s targeted programs (generally at or below 80% of the Area Median Income). They’re looking at a new EV with a sticker price of $34,995. In most states, that’s the end of the story. In Colorado, it’s just the beginning of the math.

Here’s how they can stack the savings:

- The Base State Tax Credit: Colorado offers a foundational tax credit of $3,500 for the purchase or lease of a new EV with an MSRP up to $80,000.

- The “Affordability” Bonus: To encourage the adoption of more accessible models, the state adds an extra $2,500 tax credit for any new EV with an MSRP under $35,000. Our Aurora family’s chosen car qualifies. Their total state tax credit is now $3,500 + $2,500 = $6,000.

- The Vehicle Exchange Colorado (VXC) Rebate: This is the most powerful part of the stack. The VXC program provides a generous point-of-sale rebate to income-qualified residents who trade in an older vehicle (at least 12 years old). In late 2025, the rebate for a new EV is a staggering $9,000. This isn’t a future tax credit; it’s an immediate discount that comes right off the price of the car at the dealership.

The Grand Total: By stacking these three programs, the family’s total savings come to $6,000 in future tax credits plus a $9,000 instant rebate. That’s a grand total of $15,000. Their $34,995 car now has an effective cost of just $19,995.

The Urgency: There is a major catch. Colorado’s generous base tax credit is scheduled to plummet from $3,500 to just $750 on January 1, 2026. This creates a critical window for buyers. To maximize this incredible deal, action is needed before the end of 2025.

Illinois: The Early Bird Gets the Rebate

If Colorado’s strategy is about intricate stacking, Illinois’s approach is about pure, simple speed. The state offers a straightforward cash rebate program that operates on a limited budget and a first-come, first-served basis. This structure is a “brute force” method designed to get money out the door quickly and spur sales across the board until the funds are gone. For buyers, this means the early bird truly gets the worm.

The next application cycle opens on October 28, 2025, and closes on January 31, 2026. The program provides a direct cash rebate, not a tax credit, with two tiers of funding:

- $4,000 for low-income buyers.

- $2,000 for all other eligible buyers.

- A $1,500 rebate is also available for the purchase of an electric motorcycle.

The Urgency: The key phrase here is “first-come, first-served.” The program is funded with a limited budget—$14 million for the current fiscal year—and applications are processed in the order they are received, with priority given to low-income applicants. In previous funding rounds, the money has been completely exhausted well before the official closing date. This creates a clear call to action for any interested Illinois resident: have your documents ready to submit the moment the application window opens.

To qualify, you must be an Illinois resident, purchase the vehicle from a licensed Illinois dealer, and agree to retain ownership for at least 12 consecutive months. It’s also important to note that leased vehicles are not eligible for this rebate. When you apply, you’ll need to have a copy of the bill of sale, proof of purchase, your Illinois vehicle registration, and a completed IRS W-9 form ready to go.

California: The Hyper-Local Gold Rush

California, long the undisputed leader in EV adoption, has evolved its incentive strategy. The state’s EV market is now mature, so it has shifted away from broad, universal rebates like the old Clean Vehicle Rebate Project (CVRP), which is no longer accepting new applications. Instead, California is now using its incentive money like a scalpel, targeting specific goals like air quality and affordability in the communities that need it most. Saving big money here is now a hyper-local affair that rewards income-qualified buyers who are willing to do a little digging.

The state’s flagship program is now Clean Cars 4 All. This program isn’t run by the state directly but by regional air districts. It provides up to $12,000 for income-qualified households that scrap an older, high-polluting vehicle to purchase a new or used EV. On top of that, the program can provide an additional $2,000 for the installation of home charging equipment.

Beyond that single program, the real opportunity in California lies in the vast and complex network of rebates offered by local utility providers. Companies like Southern California Edison (SCE) and the Los Angeles Department of Water and Power (LADWP) offer thousands of dollars in additional rebates, often for used EVs, which helps make them more accessible. The key takeaway for Californians is that your potential savings are now primarily determined by three factors: your zip code (which determines your air district and utility), your household income, and your willingness to scrap an old car.

New York: Instant Savings Now, Bigger Things on the Horizon?

New York’s approach prioritizes consumer simplicity and the psychological power of an immediate discount. The state offers the Drive Clean Rebate, one of the most accessible and satisfying incentives in the country. It’s a point-of-sale rebate of up to $2,000 that is applied directly by the dealer when you purchase the car. There are no forms to mail in or tax credits to wait for; the price you pay is simply lower. The exact rebate amount is tiered based on the vehicle’s all-electric range and its MSRP, rewarding cars that can go farther on a charge.

While this instant rebate is a great perk, New York legislators are also looking to the future. Recognizing the void left by the federal government, they are actively working on proposed legislation (S8113 / A8832) that would establish a new, substantial state-level tax credit for 2026 and beyond. The proposal aims to mirror the expired federal amounts: up to $7,500 for new EVs and $4,000 for used EVs. This gives New York buyers a solid benefit right now, with the promising prospect of even bigger savings on the horizon.

Texas: Beyond the Dealership Discount

Texas is a relative newcomer to the state incentive game, but its approach highlights a different, and equally important, kind of savings. In late 2025, the state launched the Light-Duty Motor Vehicle Purchase or Lease Incentive Program (LDPLIP). This is a first-come, first-served grant program that offers up to $2,500 toward the purchase of a new EV or PHEV, with a limited number of grants available.

However, the real story of EV savings in Texas often lies beyond the initial purchase price. The most significant long-term financial benefits come from the state’s competitive electricity market.

Utility providers like Austin Energy, CPS Energy, and GEXA offer powerful incentives that dramatically lower your “fueling” costs over the life of the vehicle.

These include substantial rebates for home charger installation and, more importantly, specialized time-of-use electricity rates or “free nights” plans. These plans make charging your EV at home overnight incredibly cheap, often just a few cents per kilowatt-hour. This is a different kind of incentive—one that doesn’t just give you a discount on day one but pays you a dividend every single month you own the car.

Quick-Reference Guide to Top State EV Incentives (Late 2025/2026)

| State | Program Name | Max Incentive | Type (Credit/Rebate/Grant) | Key Takeaway / Deadline |

| Colorado | State Tax Credit + VXC | $15,000 (stacked) | Tax Credit & Rebate | Act before Jan 1, 2026 to maximize savings! |

| Illinois | EV Rebate Program | $4,000 | Rebate | Apply ASAP when the cycle opens (Oct. 28, 2025). |

| California | Clean Cars 4 All | $14,000 (incl. charging) | Rebate | Hyper-local; depends on income and zip code. |

| New York | Drive Clean Rebate | $2,000 | Rebate | Simple, instant discount at the dealership. |

| Texas | LDPLIP + Utility Offers | $2,500 (Grant) | Grant & Rate Plans | Focus on long-term savings from cheap charging rates. |

The Last Federal Perk: Don’t Forget to Claim Your $1,000 for a Home Charger

While the big federal credits for buying an EV are gone, there is one last, important piece of the federal puzzle still available to every U.S. resident. It’s the unsung hero of EV savings: the Alternative Fuel Vehicle Refueling Property Credit, also known as Section 30C.

The survival of this specific credit, even as the vehicle purchase credits were eliminated, signals a strategic pivot in federal policy. The government may have stepped back from helping you buy the car, but it is still very much invested in helping you build the “gas station” in your garage. This suggests a recognition that a lack of convenient and affordable charging is a primary barrier to widespread EV adoption.

The focus is shifting from incentivizing the vehicle itself to building the essential infrastructure that supports the entire EV ecosystem. For you, this means that even if you live in a state with no vehicle incentives, the federal government is still willing to help you with the crucial step of setting up for home charging.

How It Works

This tax credit is designed to help you pay for the cost of purchasing and installing a qualified EV charger at your home or business. Here are the details in the simplest terms:

- What it is: A federal tax credit to offset the cost of your home charging equipment and the labor to install it.

- How much you get: For a residential installation, the credit is for 30% of your total cost (including the charger itself and the electrician’s bill), up to a maximum credit of $1,000.

- The Final, Final Deadline: This is critical. The credit has a firm expiration date. The charging equipment must be “placed in service”—meaning fully installed and operational—before June 30, 2026. Simply buying the charger before this date is not enough; it must be up and running. This is the last major federal EV-related deadline for consumers.

It’s important to understand that this is a non-refundable tax credit. That means it can reduce your federal tax liability down to zero, but you won’t get any portion of it back as a cash refund if the credit is larger than what you owe in taxes.

For small business owners or self-employed individuals reading this, it’s worth noting that the commercial version of this credit is even more generous. For businesses, the base credit is 6% of the cost, but it can jump to 30% if certain prevailing wage and apprenticeship requirements are met, with a much higher cap of $100,000 per charger.

Your EV tax credit Buying Playbook for 2026 and Beyond

We’ve covered the past, the present, and the future of EV incentives. Now, let’s put it all together into a simple, sequential, and empowering action plan that you can follow to maximize your savings on an electric car in this new era.

Guide to Maximizing Your Savings

- Step 1: Start with Your State. Your very first stop on this journey should be your state’s official energy office or environmental protection agency website. The most effective way to find this is with a simple online search for ” EV incentives.” This will lead you to the official government source, which provides the most accurate and up-to-date information on available tax credits and rebate programs. This is your source of truth.

- Step 2: Call Your Electric Company. Don’t stop at the state level. Your local utility provider is your next best friend in this process. Visit their website or call their customer service line and ask specifically about programs for EV owners. Inquire about special EV electricity rates (like time-of-use plans), rebates for purchasing a home charger, and any other incentives they might offer. This is where you’ll find the powerful long-term savings that lower your cost of ownership every month.

- Step 3: Check Your Income. Before you assume you don’t qualify for the best programs, make a point to specifically search for “income-qualified EV programs” in your state or region. Many people are surprised to find that the income thresholds are higher than they expect. The largest available discounts are often found in programs designed for moderate-income households, like Colorado’s Vehicle Exchange Colorado (VXC) and California’s Clean Cars 4 All. Don’t leave this money on the table.

- Step 4: Plan Your Charger Installation. As you’re shopping for your car, start planning for your home charger. Remember the last federal perk! Get a few quotes from qualified electricians for the installation. Make sure you can get the charger purchased, installed, and fully operational before the final June 30, 2026, deadline to ensure you can claim your final federal tax credit of up to $1,000.

- Step 5: Trust, But Verify. In this rapidly changing landscape, it’s crucial to rely on official sources. While blogs and dealership summaries can be helpful starting points, the rules can and do change. For the final word on tax-related questions, always go to IRS.gov. For the most current list of eligible vehicles for any remaining programs, use the federal government’s FuelEconomy.gov website. These official sources will protect you from outdated or inaccurate information.

Conclusion: A Smarter Way to Buy Electric

The era of a single, dominant federal EV tax credit has come to an end. It has been replaced by a more fragmented, more complex, but still incredibly valuable landscape of state, local, and utility incentives. The key to saving money on an electric car has shifted from simple eligibility to smart, local strategy.

Realizing significant upfront savings on an EV purchase is still entirely possible, but it now requires more localized research and strategic planning. The concept of “incentive stacking”—skillfully combining multiple programs from different sources—has become the new path to achieving the largest discounts. While the research burden on you, the consumer, has certainly increased, the financial rewards for diligence can be substantial, especially in states with strong, multi-layered programs.

The journey to your first electric car may have a few more steps than it used to, but the destination—driving a car that is cheaper to fuel, better for the environment, and a blast to drive—is more than worth it. By following this guide and doing your local homework, you have the power to stack the savings and make an EV even more affordable. The treasure hunt begins now.