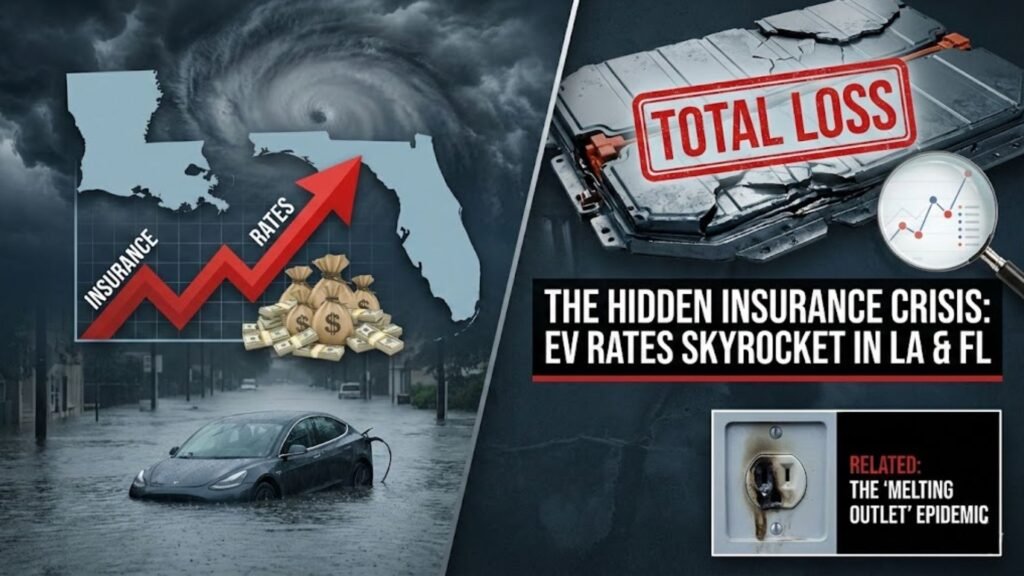

If you opened your renewal packet this month and felt your jaw drop, you aren’t alone. Data indicates that insurance premiums for EVs are rising approximately 49% faster than for internal combustion engine (ICE) vehicles, with states like Louisiana seeing average premiums hit $5,197.

This isn’t just inflation. It isn’t random. It is driven by a structural “total loss” economic crisis hiding in your battery pack.

For our readers in the Southeast, specifically those asking about electric car insurance Florida Louisiana rates, the situation is compounded by a perfect storm of climate risk and legal environments. This report digs into the data to explain why your premium rivals your car payment and what the EV insurance cost 2025/2026 landscape looks like.

The “Total Loss” Economics of Battery Packs

The primary driver of these rate hikes is a lack of repairability. In a traditional car, a minor fender bender is a $2,000 repair. In an electric vehicle, that same impact often scrapes the undercarriage shield protecting the high-voltage battery.

Because most automakers do not provide third-party access to internal battery diagnostics, insurance adjusters cannot verify if the cells inside are safe. Facing the risk of a future fire (thermal runaway), they have no choice but to write off the entire car.

This has caused EV total loss rates to spike for minor accidents. When a $50,000 car is totaled over a cosmetic dent on the battery casing, premiums must rise across the board to cover those payouts. Until battery repairability standards improve, this “scrape-to-total” pipeline will keep rates high.

Regional Spotlight: Why Florida and Louisiana Are Outliers

While the battery issue is national, the financial pain is heavily localized.

Louisiana ($5,197 Avg) and The Litigation Loop

Louisiana is currently the most expensive state for EV insurance. The state has a unique legal environment that encourages high claim litigation, combined with a high rate of uninsured motorists. When you add the high capital cost of EVs to this mix, carriers are forced to price policies at extreme levels to protect themselves.

Florida’s Climate and Density crisis

Florida faces similar challenges but with higher population density in luxury EV hubs like Miami. The risk of hurricane-induced flooding is a major factor. Saltwater is kryptonite to EV batteries; a flooded EV is almost always a guaranteed total loss due to corrosion risk.

Below is a breakdown of how these markets compare to the national average.

Projected Annual EV Insurance Premiums (2025 Estimates)

| Region | Avg. Annual Premium | Primary Risk Factors |

| Louisiana | $5,197 | Litigation, Flood Risk, Uninsured Drivers |

| Florida | $4,200 – $4,800 | Hurricanes, High Repair Costs, Density |

| National Avg | $2,400 – $3,000 | Parts Availability, Specialized Labor |

| Midwest (Low Risk) | $1,450 | Lower Collision Frequency, Lower Labor Rates |

Why Is Tesla Insurance So High?

Tesla owners specifically often ask why is Tesla insurance so high compared to other EVs. While Teslas are safe, they are expensive to fix.

- Gigacasting: Tesla uses massive single-piece castings for the front and rear of the vehicle. While this makes manufacturing cheaper, it makes collision repair difficult. You often cannot just “pound out a dent”—you have to replace a structural component of the car.

- Parts Monopoly: Tesla restricts parts distribution, leading to longer repair times. This forces insurers to pay for weeks of rental car coverage while waiting for a bumper.

- Performance: The high acceleration of models like the Model 3 Performance leads to higher accident severity rates statistically.

Outlook: EV Insurance Cost 2025/2026

Will rates go down? The short answer is: not yet. The EV insurance cost 2025/2026 trend line suggests premiums will remain elevated until independent shops gain the ability to repair battery packs rather than replace them.

If you are currently shopping for a vehicle, do not ignore this cost. One of the 5 common mistakes to avoid when buying your first EV is calculating your budget based on the monthly loan payment while forgetting that insurance could double that figure.

Additionally, home safety affects your overall risk profile. We are seeing more scrutiny on home charging setups. Understanding why EV charger outlets melt is critical, as insurers may begin to deny claims related to improper home infrastructure in the future.

Frequently Asked Questions (FAQs)

- Why are EV insurance premiums rising faster than gas cars?EVs have higher repair costs due to specialized labor and expensive parts. Furthermore, minor damage to the battery pack often results in a total loss because of the inability to repair or diagnose internal cell damage.

- How much is electric car insurance in Louisiana?Recent data suggests the average annual premium in Louisiana has hit approximately $5,197, making it one of the most expensive states for EV owners.

- Will EV insurance rates drop in 2026?Rates are expected to stabilize but likely won’t drop significantly until automakers improve battery repairability and open up diagnostic data to third-party repair shops.

- Does Florida have high EV insurance rates?Yes. Florida’s combination of hurricane risks (flood damage to batteries) and high vehicle density in metro areas keeps premiums significantly above the national average.