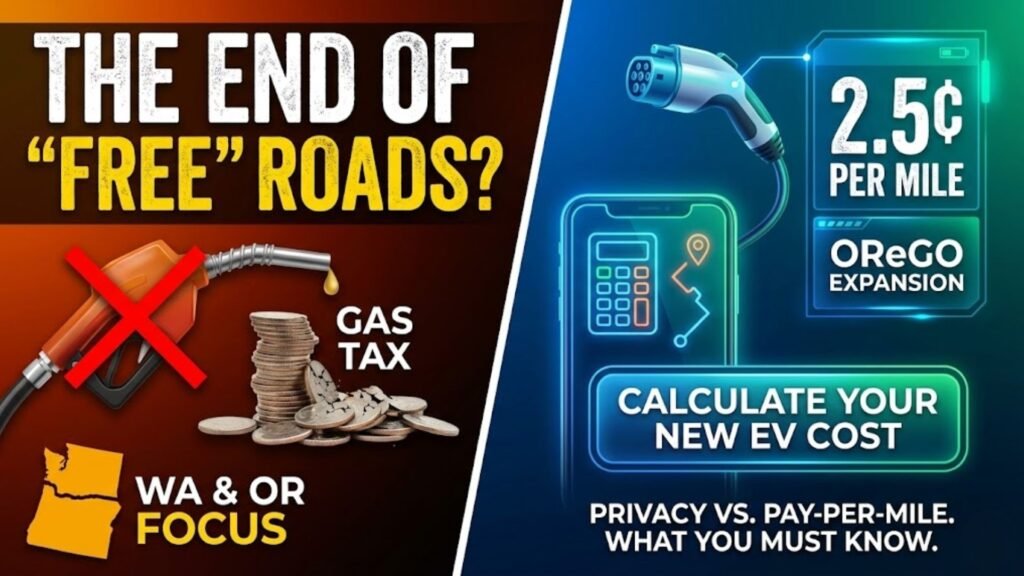

For decades, the deal was simple: you buy gas, you pay a tax, and that tax fixes the potholes. But with the massive shift to electric vehicles, the gas tax revenue is plummeting. The government’s solution? Road Usage Charges (RUC).

If you drive an EV in the Pacific Northwest, the “free ride” on infrastructure is officially over. States are moving away from taxing fuel and toward taxing distance.

This shift fundamentally alters the “cost per mile” calculation for every EV owner. Whether you are in Washington, Oregon, or watching the California road charge pilot, you need to know if this new system will save you money—or cost you a fortune.

The Death of the Gas Tax

Before we do the math, understand the context. The gas tax is a “pay-as-you-go” system. If you don’t drive, you don’t pay.

Currently, most states hit EV drivers with a massive flat annual registration fee to make up for lost gas tax revenue. It is a blunt instrument. Grandma driving her Nissan Leaf to church on Sundays pays the same fee as a sales rep driving a Tesla Model Y 30,000 miles a year.

Pay per mile tax EV 2025 programs aim to fix this fairness issue. But is “fair” actually “cheaper” for you?

Washington State: The Break-Even Calculator

Washington currently charges EV owners a hefty annual registration fee (approx. $225 total) to fund roads. The EV road usage charge Washington proposes is roughly 2.5 to 2.6 cents per mile as an alternative (currently voluntary, but likely mandatory in the future).

Let’s run the numbers to see where the break-even point lies.

The Math

- Fixed Annual Fee: ~$225

- Proposed RUC Rate: $0.026 per mile

$$\frac{\$225}{\$0.026} \approx 8,653 \text{ miles}$$

The Verdict

- Low Mileage Drivers (Under 8,600 miles/year): You are likely overpaying with the current flat fee. Switching to a per-mile charge would save you money.

- High Mileage Drivers (Over 8,600 miles/year): The flat fee is a bargain. If you drive 15,000 miles a year, a RUC would cost you nearly $390—almost double the current flat fee.

Note: As of late 2025, Washington’s program is transitioning. Always check the Department of Licensing for the absolute latest voluntary enrollment incentives.

Oregon OReGO Program: The Pioneer

Oregon is further ahead. The Oregon OReGO program is fully operational and voluntary.

- The Deal: You voluntarily pay a road usage charge (currently rising to approx. 2.3 cents/mile).

- The Carrot: In exchange, Oregon drastically reduces your vehicle registration fee. instead of paying hundreds of dollars every two years, you pay a nominal base fee.

Who Should Join OReGO?

If you have a secondary EV that sits in the garage most of the week, OReGO is a no-brainer. You avoid the high upfront registration cost and only pay pennies for the few miles you actually drive. However, for road warriors commuting from Portland to Salem daily, the pay-per-mile costs will quickly eclipse the savings from the lower registration fee.

California and Beyond

California recently concluded its latest California road charge pilot. While a mandatory program isn’t in effect for 2025, the data suggests a similar rate (2-3 cents per mile) is inevitable. California is looking closely at the “revenue neutral” model—ensuring the state collects the same amount of money as it did with gas taxes, just from a different source.

The “Big Brother” Problem: Privacy vs. Odometer

The biggest hurdle to RUC isn’t cost; it’s privacy. “I don’t want the government tracking where I go.”

States have anticipated this. Almost every RUC program offers two reporting methods:

1. The High-Tech Option (GPS)

You plug a dongle into your car’s OBD-II port.

- Pros: It automatically deducts miles driven out of state or on private roads (you shouldn’t pay Washington taxes for driving in Idaho).

- Cons: It involves location tracking, though data is usually anonymized and handled by third-party vendors, not the government directly.

2. The Low-Tech Option (Odometer)

- Pros: Zero location tracking. You simply take a photo of your dashboard odometer once a year.

- Cons: You pay for every mile the wheel turns, even if you drove those miles in a different state or on your own driveway.

FAQ: Road Usage Charges

- Will I pay both the gas tax and the RUC?No. The systems are designed to be mutually exclusive. If you pay the RUC, you typically get a credit for any gas tax paid (for hybrids) or are exempt from the EV surcharges.

- Is the EV road usage charge Washington mandatory in 2025?As of early 2025, it remains largely voluntary or in pilot phases for most passenger vehicles, but legislation is moving toward making it mandatory for new model years soon.

- How do I pay the Oregon OReGO program fees?It operates like a utility bill. You set up a “wallet” with a third-party account manager (like Azuga), and charges are deducted automatically based on your reporting.

- Can I cheat the system?It is difficult. Odometer readings are verified during vehicle inspections, title transfers, or registration renewals. Falsifying mileage is generally considered fraud.

Conclusion

The era of paying for roads at the pump is ending. For EV owners, Road Usage Charges are the future. If you drive less than the average American (13,500 miles/year), this shift might actually put money back in your pocket.

Don’t fear the change—calculate it.

Want to save money on every mile you do drive? Check out our guide to Eco Driving.